Mortgage Insurance is a protection for the borrower and their family against default due to accidents, illnesses or death, don’t leave family with the burden of not being able to pay their mortgage and loosing their home as a result

Mortgage Insurance is a protection for the borrower and their family against default due to accidents, illnesses or death, don’t leave family with the burden of not being able to pay their mortgage and loosing their home as a result

Mortgage Insurance offers total portability, this means that you can move your mortgage as many times as you like from one lender to another lender and you never lose your protection

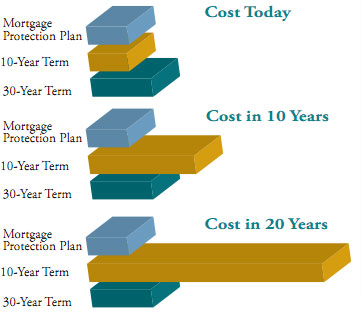

The following comparison explains the cost of your Mortgage Insurance, versus a 10-year and a 30-year term life insurance. (Mortgage protection plan in Blue)

Mortgage Insurance offers Immediate protection for everyone: Never decline any application for life insurance as long as your mortgage is less than 1,000,000.00, offers protection to everyone, aged 18-65

Mortgage Insurance offers great value and convenience with premium rates that are always attractive compared to your mortgage lender’s plan or with term life insurance, and the payments can be amortized over the life of your mortgage term

Mortgage Insurance offers satisfaction guaranteed: Take up to 60 days to compare, and if you and a protection option that you like better, simply cancel and we will refund any premiums you’ve already paid

MPP Pays Claims – MPP does upfront medical underwriting so that we can pay claims when they arise. Clients can apply for coverage and leave the medical questions blank- MPP will contact clients to schedule a Tele-Interview for medical underwriting.

MPP will not only ensure the fixed portion of a mortgage but will also ensure the revolving line of credit portion too if the client so chooses.

After Funding – Clients can apply for MPP insurance even after their mortgage has funded. It’s never too late to apply for MPP!

Portability – MPP is fully portable from lender to lender and property to property. Premiums will not go up for the full amortization of the mortgage.

Disability Interest Rate Protection Your mortgage payment may go up over time due to increased interest rate changes but MPP won’t charge you more. Even if the MPP disability premium you originally paid was set to cover a much lower monthly payment you will always be fully protected when interest rates change and your mortgage payment goes up.

Disability Standalone – Clients are not required to take Life insurance in order to get Disability coverage. The Disability insurance is available on a standalone basis.

Disability Non-Taxable – In the event of a disability, MPP will make the monthly mortgage payments. Since we pay the lender and not the client, these benefits do not have to be reported as income to CRA or your private disability insurer and are NOT subject to income taxes.

Disability for BFS – Self-Employed clients need Disability insurance the most yet they may not qualify for coverage or they may find it expensive due to yearly fluctuations in their reported income. With MPP Disability coverage, clients are approved based on their health (not on their income) and in the event of a Disability MPP will make their mortgage

payments.

Disability Own Occupation Some insurance companies will not pay a Disability claim as long as the individual is able to do any kind of job. MPP covers you for your own occupation in the event of Disability. This means, if you perform the functions of the job you normally do, MPP will not make you do a lesser job to avoid paying the claim.

Disability Unlimited Offer There are no limits to the number of disability claims your client can make. Each disability will pay for a 24 month period. MPP market research showed that most people who filed a disability claim were back to work within 12 months or less. Therefore, our 24-month product sufficiently covers the majority of disabilities for the length of time needed by most clients to recover. It’s also one of the most affordable Disability products on the market

Interim Mortgage Payments In the event of death, there can often be delays getting the

required paperwork from doctors due to their hectic schedules. Regardless of how long it may take to get the necessary documents, MPP will start making the mortgage payments on behalf of the client until such time as the claim is paid. This unique feature is offered exclusively through MPP.

Active Immediate Coverage The value you add to your clients (that no one else can add) is you can get your clients protected from the moment you submit the completed MPP application along with banking. In a purchase situation with more than one party in the contract, once subjects are removed your clients are obligated to fulfill the contract (even if one of the purchasers dies). Failure to complete the purchase could result in a lawsuit against your remaining client.

MPP says YES! If you have health issues or other health related concerns MPP will still offer some form of Life and Disability insurance to everyone who applies.

60 Day Money Back Guarantee MPP offers a full 60 Day Money Back Guarantee. If your client changes their mind for any reason they can just call MPP for a full refund within 60 days.

If you only have a CHMC Mortgage loan insurance; that protects the lender against default; A Mortgage Insurance protects you and your family against default.

| Call or text 416-262-7139 | ||

|  |

|