Ontario Land Transfer Tax is charged to the home-buyer and applies whenever a land or an interest in land in Ontario is purchased,

Ontario Land Transfer Tax is charged to the home-buyer and applies whenever a land or an interest in land in Ontario is purchased,

The applicant buyer pays the Ontario’s land transfer tax at the time of purchase, the term “land” includes any buildings, buildings to be constructed, and fixtures (such as light fixtures, built-in appliances, and cabinetry).

Land transfer tax is normally based on the amount paid for the land, in addition to the amount remaining on any mortgage or debt assumed as part of the arrangement to buy the land.

In some cases, land transfer tax is based on the fair market value of the land, for example, where:

- The transfer of a lease with a remaining term that can exceed 50 years

- The transfer of land is from a corporation to one of its shareholders, or

- The transfer of land is to a corporation if shares of the corporation are issued.

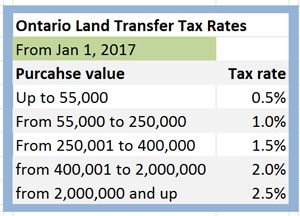

Current Ontario Land Transfer Tax rates as of January 1, 2017

First-time home-buyers rebate

First-time home-buyers rebate

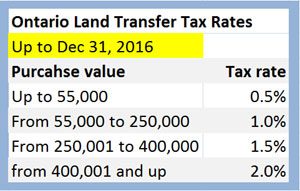

Up to December 31, 2016, first-time home-buyers qualify for up to 2,000 land transfer tax rebate.

Ontario Land Transfer Tax rates as of January 1, 2017

From January 1st, 2017 onward, the new Ontario Land Transfer Tax for first-time home-buyers will be exempted on the first 368,000 of a land purchase price and first-time home-buyers will also be eligible for up to a 4,000 tax rebate on the non-exempted amount.

Also from January 1st, 2017 the new Ontario Land Transfer Tax rate increases on properties which purchase price exceeds 2 Million, the increase is to 2.5% from a 2%.

An appraisal of the properties before the purchase is most likely going to be ordered.

Your opinion is welcomed at the bottom of the page.

Ontario Land transfer calculator

Contact me if you have a question or need my services as your mortgage agent