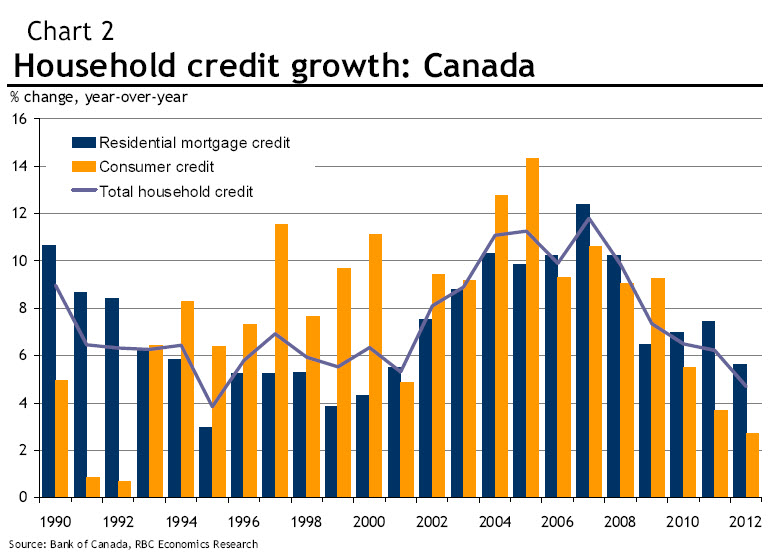

Household credit growth in Canada

The information on the following graph helps us observe that from the past 7 year approximately borrowers are paying more importance to their secure mortgage credit rather than easy to obtain commercial credit like credit cards; Thanks in part to the federal government regulations and on to the slow economic activity that has affected many industries and borrowers in all economic sectors

Borrowers have learned to use the strategies offered by mortgage agents all around Canada; mortgage strategies like mortgage refinances, debt consolidation, lines of credit and first mortgages, wisely negotiated by mortgage agents at the lowest mortgage rates.

Your personal observation on the matter in important to gain a broad perspective on how mortgage loans may be affecting you; Write a line at the bottom o this post!