Home sale prices in Ontario

Is it really worth it to buy a house? That is a question that some renters that I have come across with have or had, like John and Sue (not real names) from Toronto, who were renting because they never thought that they could buy a house considering their financial situation. After our first meeting at that corner coffee shop (it was very crowded by the way), they felt comfortable enough to take the next step

The next step was, to decide whether to start their mortgage assessment or not, they decided to go ahead as they had nothing to lose and now they own a condo on a 15th floor that is more comfortable than the apartment they were renting and in a safer area; their mortgage payments are currently lower than what they were paying as rent.

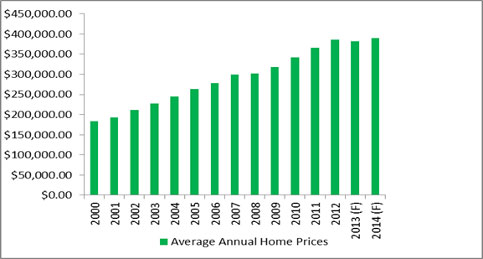

The following chart from CHMC, illustrates in a simple way the average home sale prices in Ontario, includes a forecast for the years 2013 & 2014.

What you as a borrower can take from this is that, those who in the past years, were able to invest in a real estate and capable of keeping their investment, have now benefited by the growth of their equity, even through the slow economy that we lived in the past few years.

In the graph, as we observe a steady increase in home sale prices, we should also consider the savings resulting from low mortgage rates (not expressed in the chart below).

The growth of wealth in equity offered by the residential real estate industry, should be considered as a clear message, and an invitation to those who are currently renting, to invest securely and buy their homes now, rather than later.

Situations that prevent renters from buying a home like, low credit, no initial down payment, low income and others can be overcomed with a clear and solid strategy and here is where I can help you.

Contact me now for more information