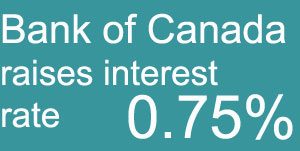

Bank of Canada raises interest rate to 0.75% from 0.5%

Bank of Canada raises interest rate to 0.75% from 0.5%

This increase is applied directly to the overnight key lending rate.

This means that the Bank of Canada feels that our economy is strong.

Strong economic trade and a bit higher inflation are expected throughout the country, so the Bank of Canada finds the need to stay ahead of the curve.

The way this increase affects our mortgage holders is in two main ways:

- Immediate increase in those mortgages with a variable rate which is normally stated as prime (portion increasing to .75% from .5%) plus some previously agreed upon your mortgage basis points (remaining as agreed)

- Mortgage rates in future mortgage contracts will be offering slightly higher interest rates since currently still on the low side.

If you as a borrower have an income with a fixed income and are not expecting any substantial salary or income increase it might be better to apply for a mortgage with a fixed rate, to avoid instability.

You can apply securely for your mortgage here